At Vida, we believe that transferring your financial wisdom to the next generation is a profound legacy. Our NextGen Financial Education Program is specifically designed to provide personalized guidance, helping your heirs understand the opportunities and risks associated with wealth. This program equips them to navigate the financial landscape responsibly, offering a distinct advantage that traditional education cannot match.

This exceptional program acts as a priceless entry point to financial management for young individuals. It seamlessly expands upon our current relationship with you, empowering your family to safeguard and expand wealth for future generations.

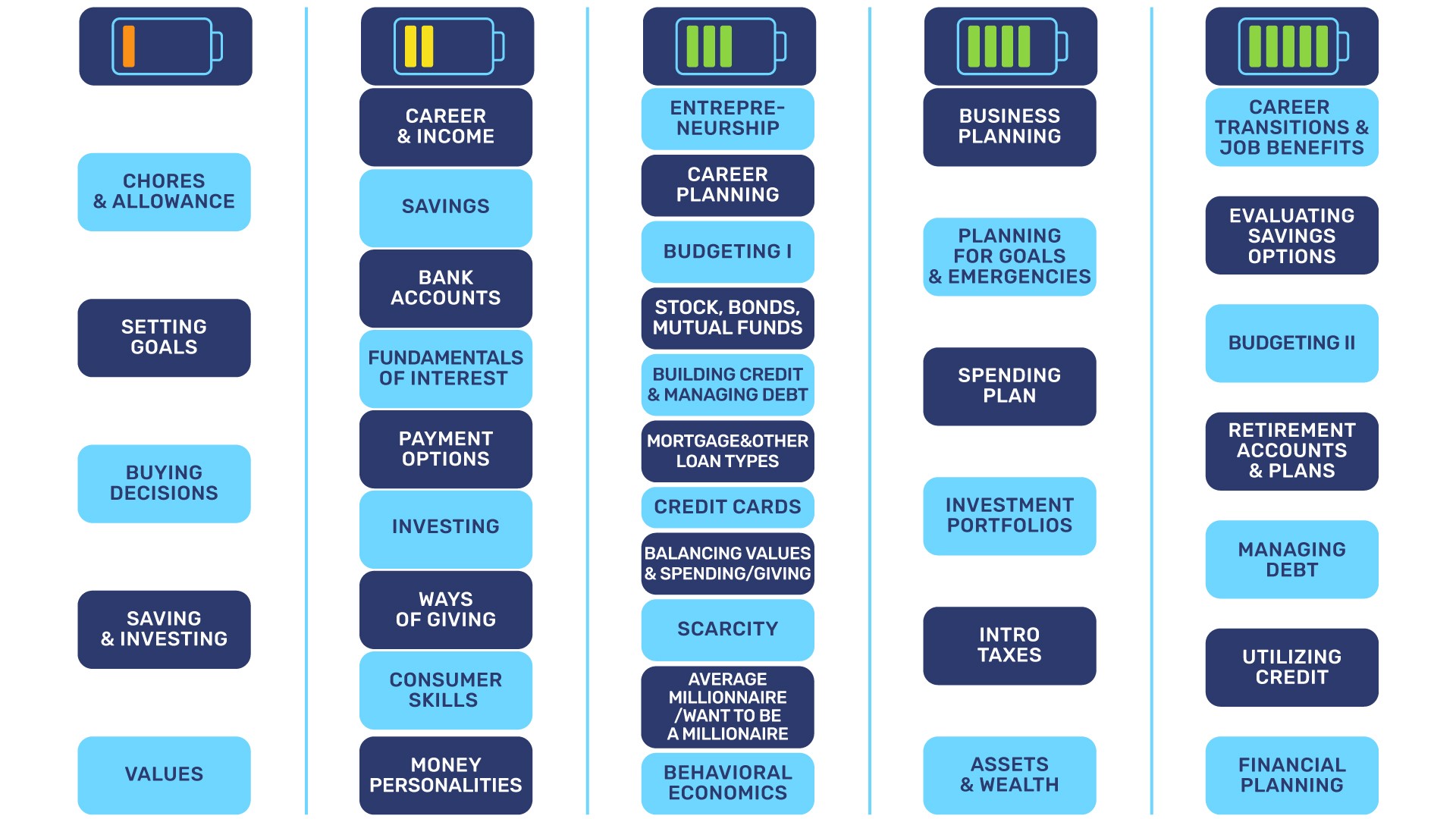

While this service is complimentary for our esteemed clients, it is also available as a stand-alone offering, allowing others to benefit from its unique advantages independently. The following exceptional curriculum has been carefully crafted to provide invaluable guidance to your heirs:

Our NextGen Financial Education Program goes beyond monetary matters, focusing on equipping the next generation with essential life skills to navigate their newfound wealth responsibly. By partnering with Vida, you can ensure that the legacy you leave behind is not just measured in numbers, but in the knowledge and mindset you pass on to empower your heirs.

Together, we can shape their financial future and secure a lasting legacy for your family.